Americans continue spending for household and personal needs despite inflation, higher prices and interest rates. Therefore, brands and businesses of all sizes are motivated to spend ad dollars to communicate how they can satisfy those needs. According to Guideline’s U.S. Ad Market Tracker, after U.S. ad market spending decreased each month during Q1 2023, four of the six months during Q2 and Q3 recorded increases. Borrell Associates is forecasting a 4.4% increase in 2024 local ad spending, driven by the political cycle and an improving economy.

Advertisers, especially local advertisers and local media sales teams, must understand consumers' spending priorities. However, it is equally important to know where those local advertisers spend their ad dollars and plan to spend future dollars. Without these insights, media ad sales teams can’t help local advertisers maximize their sales and gain a greater share of their ad spending.

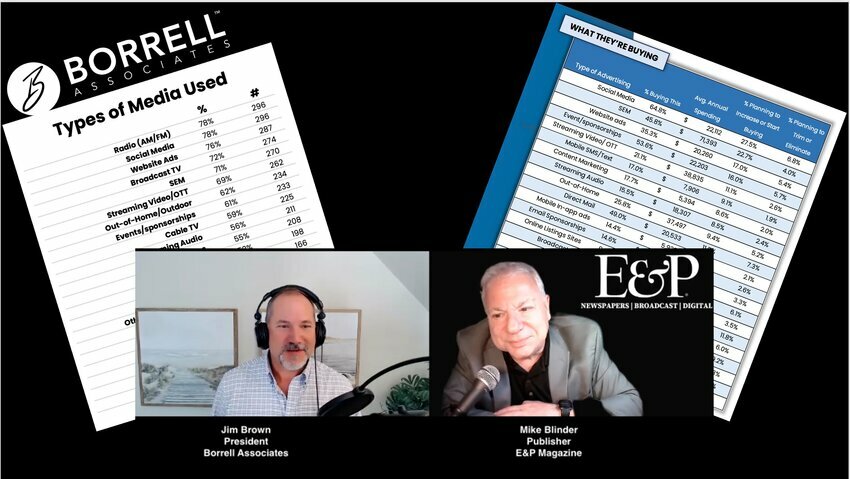

For 14 years, Borrell Associates has conducted semi-annual surveys of local advertisers to reveal where they are allocating their ad dollars, and the Q2 2023 survey offers many compelling insights and trendlines.

The 380 advertising agencies surveyed said AM/FM radio and social media were the top media they buy — both at 78%. For the 1,938 direct buyers responding to the survey, the leading media they buy are also radio and social media — but at 50% and 65%, respectively.

Jim Brown, president of Borrell Associates, explained to Mike Blinder, publisher of Editor & Publisher, during a recent “E&P Reports” vodcast why radio scored so well.

“Radio constitutes one of the largest local sales forces. It used to be newspapers, but in any market, there are probably more radio sales reps than any other media. Another reason is radio is affordable. Many of those advertisers would love to be on TV or use other types of advertising, but they can afford radio. Plus, radio reps and their stations are very creative with events and other promotions,” Brown said.

Although several legacy and non-digital media were among the top 12 types of media the Borrell survey respondents said they were using, digital advertising had the top six positions in which local advertisers planned to increase their net ad spending.

Conversely, legacy media were among those where local advertisers were planning to decrease their net spending: broadcast TV at -0.7%, radio (AM/FM) at -4.4% and newspapers at -15.6%.

The local impact of the Borrell Associates survey

It’s the application of the results from the Borrell Associates survey at the local level that reveals its greatest value. For PJ Browning, publisher and president of The Post & Courier in Charleston, South Carolina, the data is an important benchmark for its sales effort.

“We educate our account executives with Borrell survey results and use them as benchmarks when budgeting. It also contributes to our customer needs analysis and our whiteboarding strategic planning to determine advertisers' needs and who they are trying to reach at any given moment,” Browning said.

Browning’s big takeaway from the Borrell survey is newspapers are doing a better job of serving advertisers with digital media.

“We added a digital agency with a different staff and digital-only sellers. It has been the biggest game changer for us to compete in the digital space. We tried to teach our core print sales reps how to sell digital, but we discovered, as other news outlets have, that you need separate digital reps who are consumers of digital content to sell it. We’ve successfully hired people from advertising agencies where they've been selling and creating digital content much longer than we have,” Browning said.

The Borrell survey shows that 61% of local advertisers use events/sponsorships, and 5.2% more are increasing rather than cutting their events/sponsorships advertising.

According to Browning, having separate digital agency and sales teams has allowed The Post & Courier to attract advertisers who aren’t necessarily marketing goods and services to participate in events/sponsorships.

“Events and sponsorships have always been great for our brand building. What I also like about events and sponsorships is our ability to promote them. An event organization or planner may have to purchase promotional advertising to attract an audience, but print still drives people to events,” Browning said.

Selling OTT/CTV advertising is an increasing opportunity

Brown also said “over-the-top” (OTT) and “connected TV”/video (CTV) advertising, which is most commonly seen on streaming TV services, such as Hulu or free services, is another ad platform more local TV, radio and newspaper sales teams are selling but they could be selling more. Borrell forecasts a 9% increase in OTT advertising for 2024.

The survey results show more cable advertisers also bought OTT/CTV in 2023 than all other advertisers at 65%, TV advertisers were third at 50%, radio advertisers were eighth at 32%, and newspaper advertisers were eleventh at 26%.

According to Brown, the low percentages for radio and newspapers are opportunities for both to train their sales reps to offer OTT/CTV advertising to more local advertisers. Radio may have more elements in place to increase OTT/CTV buys.

“Many media companies are struggling with finding young sales talent. Radio is doing a bit better job at that than others, especially newspapers. With radio stations promoting the local appearances of bands and entertainers, it’s a different vibe that’s much more attractive to younger people,” Brown said.

He added that leadership and management at many radio stations understand and have trained their reps to understand that the local advertisers most likely interested in buying OTT/CTV are not typical TV advertisers. It’s those who can’t afford legacy TV and usually smaller businesses.

“The selling message from local media sales reps is to convince these smaller businesses that can’t outspend their bigger rivals on TV, especially during the 2024 election season. Reps must show these advertisers how to cut through the clutter in a different way that wins and resonates,” Brown said.

Know your master marketers from your novice marketers

Another compelling result from the Borrell Associates survey is the media buying differences between what Borrell calls master and novice marketers. (Master marketers have logged over 10,000 lifetime hours of marketing tasks, while novice marketers have logged less than 3,333 hours.)

Master marketers spend more in all 20 media in the survey than novice marketers. Unsurprisingly, the top four media where master markets spend the most are all digital. They also spend more than novices on radio, broadcast TV and newspapers.

The media that more novice marketers buy for the first time is an interesting mix, and they’re buying much more than master marketers. They include mobile SMS/text, out-of-home/outdoor, streaming audio, streaming video and content marketing.

“Master marketers are much more likely to buy traditional media than novices. One of the reasons is they understand the media mix a bit better. They understand you need different tools for different jobs. Media sales reps must be aware when talking with master marketers that they are more sophisticated in some ways, creating more opportunities to sell traditional and digital media,” Brown said.

Bob Sillick has held many senior positions and served a myriad of clients during his 47 years in marketing and advertising. He has been a freelance/contract content researcher, writer, editor and manager since 2010. He can be reached at bobsillick@gmail.com.

Bob Sillick has held many senior positions and served a myriad of clients during his 47 years in marketing and advertising. He has been a freelance/contract content researcher, writer, editor and manager since 2010. He can be reached at bobsillick@gmail.com.

Comments

No comments on this item Please log in to comment by clicking here